ClassJuggler version 7.5.0 in Early April

Release includes the much-requested Time Clock feature

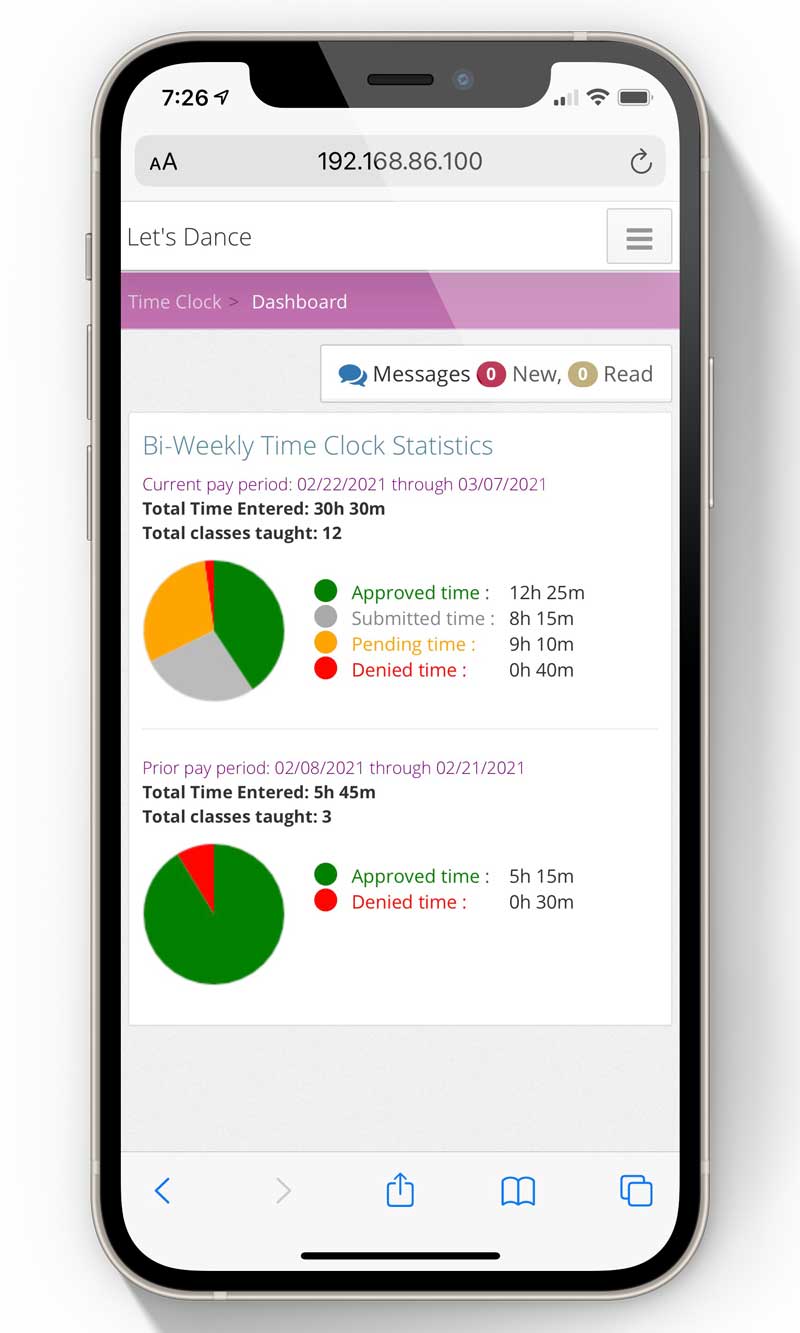

The upcoming release of ClassJuggler largely focuses on the addition of the Staff Time Clock feature for employee time tracking. This new feature is the result of help from a number of client advisors and suggestions received over the past year from many of you. The initial release will be limited to a selected group of Early Adopters who will put the Time Clock through its paces and help identify any important missing features and tweak the overall functionality. Once the feedback has been received from our early adopter group, we will release the Time Clock feature to all clients.

Handling Duplicate Family Records

On rare occasions, you may find yourself dealing with a duplicate family in your database. While this is rare — mainly due to ClassJuggler and the Customer Portal's ability to help prevent duplicates — it can be a pain to reconcile two sets of family records.

Duplicate records occur for a variety of reasons. Perhaps a parent created their own Customer record when logging onto your Customer Portal and they input an email address that was different than what you had in their existing record. Maybe a staff member entered information on a Customer that was already in your database under a different last name or was hidden in an "inactive" status. No matter the reason, the solution requires a bit of decision making. Let's look at the problem and the solutions.

We often are asked if ClassJuggler can simply "merge" the two families. While that sounds simple, there are so many pieces of data and many questions to be asked, such as, "Which address should be saved?" and "Should we drop or add students from classes?" and "Which billing and payments do we keep and which do we remove?" and so on. This leaves it up to an administrator to handle.

The best approach to eliminating your duplicate family is to do the following:

- First, look at each duplicate record and assess which record has the most extensive transaction history, has student enrollment history, policies, and other important customer and student data. Let's call this collection of family data (customer and students) the “Keeper” and the records you wish to delete the “Deleters.”

- For each important record in the family, starting with your students, see what data is on the "deleter" record that you may want on your keeper records. Manually add that data to the keepers if missing.

- Add any additional information from the "deleter" records to your keeper records until you feel you have captured the most important parts.

Once you feel you have everything you need on your keeper records for that family, go ahead and delete the "deleter" family record.

Tax Tips for 2020 Taxes

Tax Filing Date Extended to May 17

In recognition of all of the changes in tax rules for 2020 including, PPP loans and forgiveness, EIDL grants, SBA loans, unemployment payments, and others, the IRS has moved the tax deadline from the usual April 15 to Monday, May 17. Many small businesses and individuals will appreciate the extra month of time!

Tax Waivers on Unemployment Benefits up to $10,200

If you or any of your employees received unemployment benefits for part or all of 2020, your tax bill may be reduced, thanks to new changes introduced as part of the American Rescue Plan Act.

The newly passed Covid relief package waives taxes on up to $10,200 of unemployment benefits (or $20,400 if you’re married filing jointly). Here are the requirements.

The Act includes a provision that waives taxes on the first $10,200 of unemployment benefits for individual taxpayers, and double that ($20,400) if you’re married filing jointly.

This provision would effectively reduce your total amount of taxable income and therefore decrease the amount you owe the federal government.

To qualify, individuals and married couples must have filed for unemployment and have an adjusted gross income (AGI) that’s less than $150,000 in 2020. Unlike stimulus checks and the child tax credit, there is no phase out period. If your AGI in 2020 was $150,000 or greater, you’re not eligible for the unemployment tax waiver.

If you are eligible for the unemployment tax waiver but already filed your 2020 taxes before Congress passed the latest stimulus measure, you may need to be patient. The IRS website states that people in this boat should not file an amended return, but rather wait for further guidance. Online tax filing companies are awaiting guidance from the IRS so they can update their software.

-- Excerpted from March 19, 2021 article by Alexandria White, CNBC Select

Watch and Learn

If you prefer learning by watching videos, we encourage you to regularly visit our collection of tutorial videos in the ClassJuggler Tutorial Videos section of our YouTube channel.

And to make sure you don't miss any new videos, just click the SUBSCRIBE button on YouTube to be notified of the latest tutorial videos.

Also, watch for our upcoming webinar schedule featured right here in our monthly newsletter.

And as always, don't hesitate to reach out with your questions...

We really want to know if you have any suggestions for how ClassJuggler can help your businesses continue to operate as efficiently as possible during the pandemic. Please reach out to us via email or a phone call to (866) 214-6128 if you can think of anything that would make an impact on helping your business.

FREE Webinar Training Series

ClassJuggler offers free online classes and video training to its clients and demo users.

Our live webinar schedule for April is:

- Wednesday, April 14, 12pm ET (9am PT) - The Batch Report Manager: The place to go for large reports and to see the results of mass emails, billing emails, etc.

- Thursday, April 29, 2pm ET (11am PT) - The New Time Clock: See how easy it is for staff to enter hours and for admins to approve and export to payroll.

COVID-19 Resources

Information you can trust from the Centers for Disease Control and Prevention (CDC) and the Small Business Administration (SBA).

Customer Support Schedule

Customer Support will be closed for holidays on the following upcoming dates:

- April 22 - Earth Day

These dates are also visible on your sign-in screen.

Customer Support is Here for You!

Whether you're a brand-new customer or a seasoned client, you may have questions on how to best utilize ClassJuggler for your business. Our Customer Support Specialists are never more than a phone call or email away.

Give us a call at (866) 214-6128 or email support@classjuggler.com. Support hours are Mon–Fri from 8am–5pm PT.

International Clients

Skype chat is available. If you've got questions and would like to speak with someone in person, just email us and we'll arrange a time to connect with you.

Concerns or Questions. Let us know.

If you have questions, need help, or just need a friendly partner to talk with during this difficult time, please feel free to email or call us at our support line. We are working hard to maintain regular support hours during the COVID-19 crisis.