We Have a Winner!

Thank you for the ClassJuggler reviews so many of you wrote in our October-through-January promotion. As promised, not only did everyone who wrote the review via the link we provided get $10 USD gift card, but they were put into our drawing for a $50 Amazon gift certificate. And here's the ClassJuggler client who won that $50 prize:

Marcia Sarosik Dance Studio - South Lake Tahoe, CA

Marcia has been a ClassJuggler client since July 2015. To learn more about her school, the "Home of Lake Tahoe's Shining Stars," pop over to marciasarosikdancers.com. Congratulations Marcia!

Easily Track Your Referrals and Marketing Efforts

The Referrals & Marketing feature is an easy way to track how your customers found your business. And it's easy to integrate into your business intelligence, offering you valuable data on where best to spend your marketing dollars. Note: This tool can only be utilized if you have the Customer Portal enabled in your ClassJuggler account.

To use the Referrals & Marketing features, you first need to enable it. Here's how:

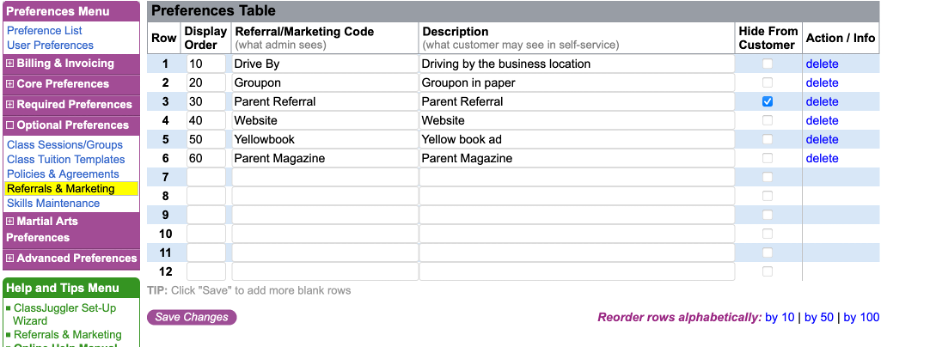

- Go to Preferences > Referrals & Marketing screen.

- Set up the table that appears with your codes and descriptions like the example below.

Once you have set up your marketing codes, you'll need to enable the feature on the Tools > Customer Portal Manager screen on the "Family Information:Customer" tab. Now that this feature is enabled, any customer that registers an account through the Customer Portal will be asked to select one of these codes from a where-did-you-hear-about-us? drop-down menu. Now that data is in your database waiting for your review. Neat!

Reporting on Your Referrals & Marketing

Running reports of your marketing data couldn't be easier. Just visit the Reports > Customer Reports > Referrals & Marketing. Here you can run a report using a variety of filters, data ranges and other report options. You'll get totals by code with any special information entered by your customers.

Tax Tips for Small Business Owners

At tax time, small businesses look for ways to save money and maximize credits and deductions. We've gathered a few useful tips for maximizing your deductions for 2021.

- Make charitable contributions - You can personally take a $300 deduction ($600 for those filing jointly) on your tax return over and above the standard deduction this year, thanks to prior stimulus bills. And your business can deduct as much as 25% of its income for charitable contributions.

- Clean up your balance sheet - Simply put, make sure your books are up-to-date and that you've accounted for any balances due from your customers that you've let linger way too long. And for that debt you simply can't collect, make sure to write those off for a tax break.

- Re-visit the Employee Retention Tax Credit - Although this credit expired for most employers at the end of September 2021, you can still go back and amend your federal payroll tax returns from 2020 and 2021 if you think you’re eligible. To be eligible you must show that you were either fully or partially shut down due to COVID or suffered revenue declines of either 50% (for the last three quarters of 2020 compared with the corresponding quarters in 2019) or 20% (for the first three quarters of 2021 compared with the corresponding quarters in 2019). If you are eligible, the credit is huge — as much as $7,000 per employee per quarter in 2021, for example — and if the credit is more than the payroll taxes you paid, then you can get the money refunded. Many payroll services offer help calculating this credit.

- Max out your retirement contributions - Even the smallest businesses can contrinute something to a retirement account. The more you can sock away each year for retirement, the more compounding earnings you'll have. Make that 7,000 ROTH contribution or invest in your 401(k).

- Finally, pay your employees to get vaccinated - Employers can still take advantage of a tax credit for the compensation paid to employees (up to a maximum of $511 per day) for time missed getting vaccinated, including additional time if there are any reactions. The president’s November 2021 mandates now require employers to give this time off, but at least you can get reimbursed.

— excepts from The Philadelphia Inquirer, Dec 2020

Watch and Learn

If you prefer learning by watching video tutorials, rather than reading how to do something new in ClassJuggler, we encourage you to keep an eye on our growing collection of tutorial videos in the ClassJuggler Tutorial Videos section of our YouTube channel. Here are a couple of our favorites:

To make sure you don't miss any new videos, just click the SUBSCRIBE button on YouTube to be notified of the latest tutorial videos.

FREE Webinar Training Series

ClassJuggler offers free online classes and video training to its clients and demo users.

Our selected pre-recorded webinars for March are:

- Student Enrollment – How to enroll a student in a class and all of the flexible options.

- Mass Text Messaging (robo texting) - Getting the most of this powerful feature.

You can watch these videos at your own pace. Feel free to explore all of our tutorial videos.

Customer Support Schedule

Customer Support will be closed for holidays on the following upcoming dates:

- Apr 22 — Earth Day

These dates are also visible on your sign-in screen.

Customer Support is Here for You!

Whether you're a brand-new customer or a seasoned client, you may have questions on how to best utilize ClassJuggler for your business. Our Customer Support Specialists are never more than a phone call or email away.

Give us a call at (866) 214-6128 or email support@classjuggler.com. Support hours are Mon–Fri from 8am–5pm PT.

International Clients

Skype chat is available. If you've got questions and would like to speak with someone in person, just email us and we'll arrange a time to connect with you.

Concerns or Questions. Let us know.

If you have questions, need help, or direction, please feel free to email or call us on our toll-free support line.